Amended Rules for Trust Accounts in Effect Jan. 1, 2022

In the October 1, 2021 Board Meeting, the Benchers approved amendments to the Rules of the Law Society of Alberta regarding the approval and management of trust accounts by Alberta lawyers. The amended Rules will go into effect on January 1, 2022. This timing allows lawyers and firms to complete their annual filings for 2021 under the existing Rules to reduce confusion.

On average, $150 billion dollars flow through Alberta lawyers’ trust accounts annually, with an average daily balance of $2 billion. These funds are divided between nearly 4,000 pooled trust accounts. The considerable amount of funds flowing through Alberta trust accounts highlights the level of risk associated with holding and managing client funds. Lawyers are responsible for managing this risk, and need appropriate controls, processes and oversight mechanisms in place.

Feedback from lawyers on the current Trust Safety Rules (largely contained within Part 5 of the Rules) indicate that the Rules can be difficult to interpret and navigate.

The effect of rule changes on the practise of law

There is little in the rule changes that should affect the day-to-day operation of most legal practices. These changes are designed to make the Rules easier to understand and follow.

The enhanced Rules highlight the accountability and oversight required by lawyers for any tasks delegated to firms’ employees. As well, the Rules have been updated to align with modern banking practices and allow lawyers to shift their practices to a less paper-based, more digital environment.

The changes will not increase the administrative burden placed on Alberta lawyers. If anything, these Rules are intended to reduce the administrative burden by making the Rules easier to follow. Existing reporting obligations for lawyers will remain unchanged with the new Rules. Responsible Lawyers will still have reporting obligations including their annual filings and any additional filings based on the trust account’s lifecycle.

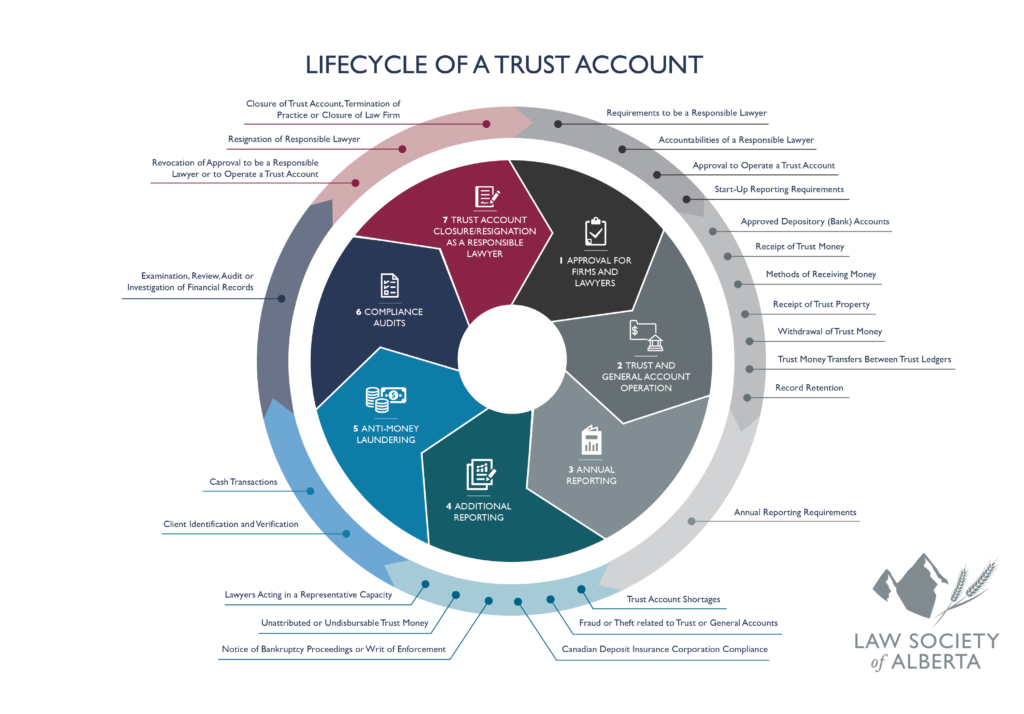

The flow of the Rules has been reworked to align with the lifecycle of a trust account, ensuring that Responsible Lawyers who operate a trust account know what steps are required for them to remain in compliance with the Rules based on where they are in the lifecycle.

The Lifecycle of a Trust Account

Starting in early 2021, the Law Society engaged key stakeholders, including responsible lawyers, bookkeepers and accountants from firms of differing sizes and practice areas, to review the key sections of the Rules to balance the necessary reporting requirements with the practise of law. After collecting that feedback, the Law Society realigned the Rules to better suit the lifecycle of a trust account and incorporated modern practices and technologies used by law firms in Alberta.

Lawyers that understand the lifecycle of a trust account – from the designation of a Responsible Lawyer through the operation, reporting and ultimate closure of the account – are better equipped to manage the risk associated with holding and managing client funds.

Every trust account goes through a similar lifecycle:

- Approval for firms and lawyers: A lawyer or a firm applies for permission to operate a trust account and becomes a Responsible Lawyer.

- Trust and general account operation: The trust account is operated by the lawyer and the firm, following best practices and the Rules of the Law Society.

- Annual reporting: The Responsible Lawyer completes annual reporting to Trust Safety.

- Additional reporting: Responsible Lawyers will, on occasion, provide additional reporting to the Law Society’s Trust Safety department in the event of trust account shortages, misappropriation or theft or other events that may expose clients’ funds to additional risk. This also includes additional reporting when they are acting in a representative capacity.

- Anti-money laundering: The rules and provisions surrounding anti-money laundering and client identification.

- Compliance audits: The process around the examination, review, audit and investigation of financial records by Trust Safety.

- Trust account closure/resignation as a Responsible Lawyer: The processes governing the closure of a trust account and the resignation or revocation of the status of Responsible Lawyer.

New tools and support

While the revised Rules do not go into effect until Jan. 1, 2022, the Law Society has developed several tools to assist with the transition and to support Alberta lawyers as they prepare for the 2022 filing period. The updated Rules will be posted shortly for your reference, as well as an accompanying chart to assist in cross-referencing the current Rules to the Jan. 1, 2022 rules and vice-versa. An FAQ is listed below, and webinars will be scheduled for January and February 2022 for a more detailed breakdown of the changes and Q&A.

The Trust Safety team is here to support lawyers and support staff through this transition and to promote understanding of the Rules. To reach out with any questions or comments, please contact Trust Safety.

Frequently Asked Questions

One of the routine aspects of practicing law is receiving money from and on behalf of clients and third parties; one of a lawyer’s most serious responsibilities is safeguarding and accounting for those funds. On average, annually $150 billion flows through Alberta lawyers’ trust accounts, with an average daily balance of $2 billion. These funds are divided between nearly 4,000 separate trust accounts.

The Law Society’s Trust Safety team protects the public interest by supporting lawyers in the proper management, accounting and safeguarding of funds entrusted to the law firm. They do this through monitoring and auditing lawyers’ trust accounting practices and helping lawyers and law firms with their trust accounting questions, concerns and needs.

The current Trust Safety Rules were developed over several years, and through multiple amendments and adjustments. Feedback from lawyers indicated that the rules were at times difficult to interpret and even harder to navigate.

After collecting feedback from key stakeholders from firms of differing sizes and practice areas, the Law Society has realigned the Trust Safety Rules to make them easier to understand, navigate and reflect the practices and technologies used by law firms in Alberta today and in the future.

While there are many of the changes to the Trust Safety Rules in terms of language and location, these changes will have few changes to the spirit of the Rules themselves. The changes are designed to make them more intelligible, easier to navigate and to modernize the Rules to modern business practices.

An example of these changes can be found in the Rules surrounding record retention, which now allow for law firms to keep either paper or digital records of their trust transaction, as well as in receipt and transfer of trust money, where electronic payment options are now explicitly allowed in lieu of cheques.

Additionally, the Rules now explicitly codify the responsibilities and obligations of Responsible Lawyers vis a vis the operation and management of trust accounts. This was done in part so lawyers handling trust money are completely aware of their duties to both the clients and the Law Society, and to understand the risks associated with delegating those duties to staff who are not covered under ALIA’s Part B – misappropriation liability indemnity coverage.

The amended Rules will go into effect on January 1, 2022. This allows lawyers and firms to complete their annual filings for 2021 under the existing Rules to reduce confusion.

Two of the key goals of the rule changes are to provide increased clarity and make the Rules easier to navigate. To that end, the Rules have been reordered to follow the lifecycle of a trust account – from approval to operate a trust account, through its operation and the associated reporting requirements, to the closure of the trust account. To better align the Rules with the lifecycle, some Rules were moved and their rule numbers subsequently reordered.

Every trust account goes through a similar lifecycle:

- Approval for firms and lawyers: A lawyer or a firm applies for permission to operate a trust account and becomes a Responsible Lawyer in the context of handling client funds.

- Trust and general account operation: The trust account is operated by the lawyer and the firm, following best practices and the Rules of the Law Society.

- Annual reporting: The lawyer completes relevant annual reporting to Trust Safety.

- Additional reporting: Lawyers will, on occasion, provide additional reporting to Trust Safety in the event of trust account shortages, misappropriation or theft or other events that may expose clients funds to additional risk.

- Anti-money laundering: The rules and provisions surrounding anti-money laundering and terrorist financing.

- Compliance audits: The process around the examination, review, audit and investigation of financial records by Trust Safety.

- Trust account closure/resignation as a Responsible Lawyer: The processes governing the closure of a trust account and the resignation or revocation of the status of Responsible Lawyer.

While the changes to the rule locations are substantial, it shouldn’t affect the day-to-day operation of most legal practices. The changes to the Rules are first and foremost designed with the intent to make them easier to understand and follow.

The rule changes deliver a clearer, more effective set of guidelines for lawyers while also assisting them in responsibly managing their funds. The Rules were revised to align with the life cycle of a trust account to make the Rules simpler, more intuitive and easier to navigate. The enhanced Rules highlight the accountability and oversight required by lawyers for any tasks delegated to firms’ employees. Applicable Rules were updated to align with modern banking practices and allow lawyers to shift their practices to a less paper-based, more digital environment.

No. If anything, these Rules should reduce the administrative burden placed on Alberta lawyers by making the Rules easier to follow.

A Responsible Lawyer is the lawyer at a firm accountable for the controls in relation to and the operation of all law firm trust accounts, general accounts, the accuracy of all reporting requirements of the law firm and the accuracy of all filing requirements of the law firm. They are the individual who is ultimately responsible for the management, accounting and safeguarding of funds entrusted to the law firm. They play a critical role in mitigating financial risk and maintaining the reputation of their firm and the legal profession.

The existing reporting obligations for lawyers will remain unchanged with the new Rules. Responsible Lawyers will still have reporting obligations including their annual filings and any additional filings based on the trust account’s lifecycle.

In-person or remote audits will, from time to time, be necessary to support lawyers in the proper management, accounting and safeguarding of funds entrusted to the law firm. While the auditing process is unchanged by these rule changes, the improved clarity and navigability of the Rules should help lawyers better follow them.